- Blog

- Feb 09

How can you get access to SAT data?

How can you get access to SAT data?

When asking for financing, SAT data provides valuable information about each company that is required to understand its current status.

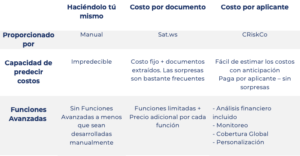

Accessing SAT data can be done in a variety of ways. You can figure out which plan is ideal for you by comparing the costs and benefits of the various options.

We’ve researched into the most important decision factors and pricing strategies for each option and will walk you through them so you can pick the best one for your company

Do it on your own The price of developing an integration to the SAT data on your own will be determined by your efforts, work hours, and other factors. It’s critical to stay current with SAT modifications. For example, the recent transition from CFDI standard 3 to CFDI 4. Plus, until you develop advanced features yourself, you won’t have them. |

Price per document You can pay a fixed fee plus a fee dependent on the quantity of documents extracted if you choose a service that charges per document. You can pay less if your clients only utilize a limited number of documents, and you can pay as you go rather than committing to a large expenditure up front if you take this strategy. It can be cost effective and quick to build if you do not require additional features such as financial insights, updates, or advanced capabilities. |

Price per application The price per application indicates that you are paying per applicant processed (RFC), with unlimited document extractions included. Financial insights created from the data are included in this plan, as well as the option of verifying the data monthly to keep it up-to-date (monitoring feature). In addition, you’ll benefit from an advanced automation approach that relies on AI and machine learning to extract risk scores and financial analytics. |

The table below will assist you in comparing the key factors of each option

So, what should I consider when choosing a strategy for my company?

Pricing strategy: In the pay by applicant approach you will be able to predict costs ahead of time, and you’ll have more advanced features for a lower price. You’ll get more for less money. If your revenue is based on number of applications this is the best solution for you.

Global Coverage: Working with a partner that can integrate with SAT data AND other leading accounting systems (Quickbooks, Xero, etc) will allow you to evaluate any type of candidate without limitations and benefit from the experience of large global provider.

Monthly Monitoring: It is vital to have up-to-date information in the credit lifecycle. This is possible thanks to the automated monitoring feature, and there is only one company in the market that provides it.

Related Posts

Case Study: Imagina Leasing’s Improved Credit Decisions

Executive Summary Imagina Leasing, a leader in Mexico’s leasing industry, was on a mission to enhance the precision and security of its credit evaluations. Facing challenges in verifying financial documents and managing risks, they turned…

- Nov 14

Strengthen Risk Management with the New Financial Suppliers Tab

We’re thrilled to unveil an exciting update to our UI! Introducing the “Financial Suppliers” tab, now available on the company reports page and in the SAT information report. Know Your Competition and Past Financing Deals…

- Jul 29

Recent Posts

Subscribe

Join our newsletter and stay up to date!