- Newsletter

- Aug 18

CRiskCo Credit Score, New Members of our Community, & more!

Newsletter August 2022

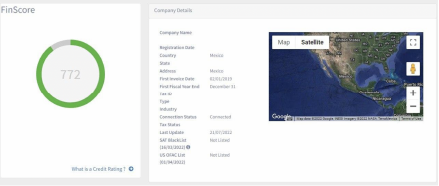

The CRiskCo Credit Score is now available!

CRiskCo’s “FinScore” is a credit scoring system that uses a proprietary algorithm to track and evaluate a company’s financial performance, resulting in a score. The score is calculated using AI and ML and is based on specific data about the company such as invoices, payments, and so on. From now on, all Mexican businesses connected to CRiskCo will get a credit score.

This metric has progressed from traditional statistical methods to the use of advanced algorithms and methods such as random forest, neural network, recursive neural network (RNN), deep neural network, and gradient boosting.

Our fin score ranges between 300 and 850. Companies with credit scores near 300 are more likely to fail and go into debt, whereas those with credit scores closer to 850 are more likely to stay in business and pay their bills.

#What can I do with a credit score?

Credit scoring is used to approve or reject credit applications, make offers to prospective consumers and businesses, determine pricing levels, and adjust the price to the risk.

We offer an additional risk data analysis and decisioning model platform in collaboration with BeeEye. Our customers can connect other data sources, such as internal databases and external APIs, to construct more complex and customized scoring models that can help them make better decisions.

We’d like to introduce Pymes Capital, our newest partner from Miami, that specializes in offering MCA digital loans to Mexican SMBs

If you want a digital, fast, and customized loan with a high acceptance rate, you should go to: https://pymescapital.com.mx/

Pymes Capital is welcoming growing SMBs to apply for financing and grow!

Visit to our team in Mexico!

Erez Saf, CEO of CRiskCo, traveled to Mexico to visit our team members, share experiences, and keep growing!

Reminder: It’s always a good time to pay visits and spend quality time with our coworkers!

Our Mexican team’s breakfast gathering with Kova Ventures in Saks, Polanco.

Welcoming our new community members

Every month, our team works hard to provide a great product while also investing time in growing our community. Special thanks to the CRiskCo team and everyone who believes in our product.

We’d like to extend a warm welcome to these new members of our community.

New blog release: The importance of Cybersecurity in the Financial Industry

The financial environment is driving service digitization with increasing force, thanks to fintech. Given the potential consequences of a data or system breach, cybersecurity is one of the industry’s top priorities.

In accordance with the foregoing, the Bank of Mexico defines three types of cyber-attack.

Would you like to learn more about Open Finance?

Related Posts

CRiskCo Joins FinAccelerate: Catch Us in Silicon Valley & More!

Newsletter October 2024 CRiskCo Joins the Exclusive 2024 FinAccelerate Program in Silicon Valley! We’re thrilled to announce that CRiskCo has been selected as one of the most innovative and exciting fintechs to participate in the…

- Oct 22

Don’t miss the latest: New features and major events

Newsletter September 2024 📊 New in CRiskCo: One-Click Excel Export for Company Metadata Simplify your workflow with our latest update: CRiskCo now allows you to download the main dashboard data in a single Excel file with…

- Sep 24

Recent Posts

Subscribe

Join our newsletter and stay up to date!