- Newsletter

- Jun 21

CRiskCo June Newsletter: CRiskCo Direct Release & Expansion

CRiskCo June newsletter 2020

We have new announcements, product improvements, and tips to help you navigate this changing environment.

Challenge or opportunity?

So much is going on right now and our communities are changing dramatically every few days. The most common acronym today PPP** was not relevant three months ago. We have been social distancing and I realized today that I haven’t worn a button-up shirt since February! A lot of us even experienced for the first time night curfews. I do hope everyone is safe, and that protests will become peaceful and encourage a change for the better.

We have gathered some important updates for you below in commercial lending and our progress in the past few challenging months.

- New partnership in Mexico with Factor Expres.

- CRiskCo Direct Lending launched to generate new qualified leads.

- Finastra release white paper: Light After Dark -COVID-19 and the importance of data collaboration.

- Employee focus, meet Kasia Kondas, our Australian Director & Account Executive

For more information reach out to us at contact@criskco.com or visit www.criskco.com

Factor Expres & CRiskCo signed a partnership to bring advanced AI technology to small and medium-sized businesses in Mexico. Bringing more access to credit in a time when access to data, ongoing monitoring, and effective technology can make a huge difference. Read more on our blog HERE

sales@criskco.com

CRiskCo Direct Lending is a new product aimed at connecting loan applicants and financial credit providers.

By meeting SMEs in their own environment (ie ERP & Accounting Systems), CRiskCo enables them to apply for different financial vehicles by the click of a button. CRiskCo automatically underwrite and submit their loan application to our Lenders network based on the product selection, application criteria of application and our matching algorithm.

Get a quick NO, and even better, a quicker YES.

For more details email sales@criskco.com

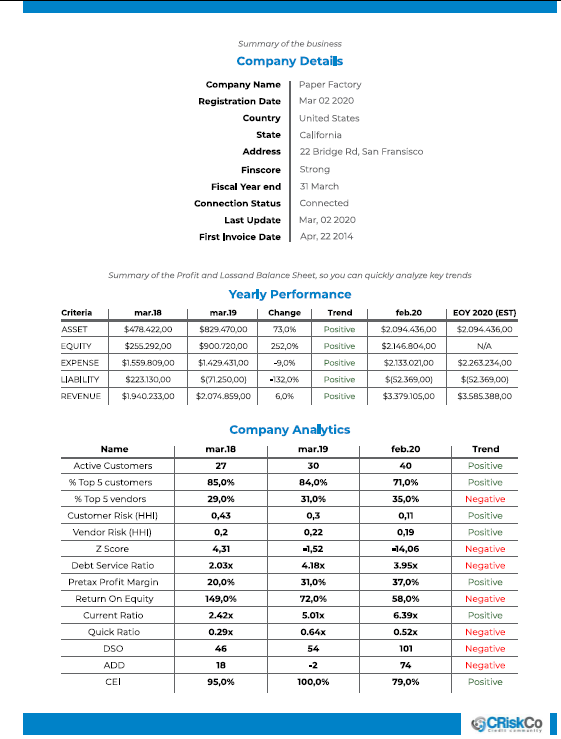

Below you can see the first page of a 3 pages company credit report, generated automatically for every new lead.

Kasia has been working from the Gold Coast during Covid-19 and as restrictions start to lift, she is starting to split her time between Brisbane and Gold Coast connecting with and supporting lenders and partners to grow their outreach and diversify their revenue streams. Reach out to Kasia on kasia@criskco.com or 0402 193 810 to discuss your post-COVID-19 plans to grow and support your clients and communities.

Related Posts

CRiskCo Joins FinAccelerate: Catch Us in Silicon Valley & More!

Newsletter October 2024 CRiskCo Joins the Exclusive 2024 FinAccelerate Program in Silicon Valley! We’re thrilled to announce that CRiskCo has been selected as one of the most innovative and exciting fintechs to participate in the…

- Oct 22

Don’t miss the latest: New features and major events

Newsletter September 2024 📊 New in CRiskCo: One-Click Excel Export for Company Metadata Simplify your workflow with our latest update: CRiskCo now allows you to download the main dashboard data in a single Excel file with…

- Sep 24

Recent Posts

Subscribe

Join our newsletter and stay up to date!