- Blog

- Dec 14

Chasing your tail with unpaid invoices?

Trading comes with the risk of clients defaulting and leaving a business without the cash they were promised. Not only do businesses have to deal with no payments but they also have expended good resources in chasing unpaid invoices. An assessment of clients’ credibility before a deal can enhance the efficiency of your business, meaning greater profits. Solutions even exist if you have engaged with a risky client and need to reduce their risk.

In this blog, we will explore the steps you can take to mitigate your risk. Offerings can come in many different packages and vary in cost and efficiency.

Credit Reports

Before a business can explore tools to outsource its risk it must first reflect upon the risk level of its customers, suppliers and itself.

Credit Bureaus Provide credit reports based on legal and registered data on private companies, and trade data on public economies as well as give a traditional credit score. It relies on the logged activity of the company and partner companies. Credit Bureaus as Dan & Bradstreet, Experian, and Veda, provide a lot of information but lack of transactional and up-to-date company financials, prevent them to provide a reliable prediction model or showing the difficulty of the future customer relationship.

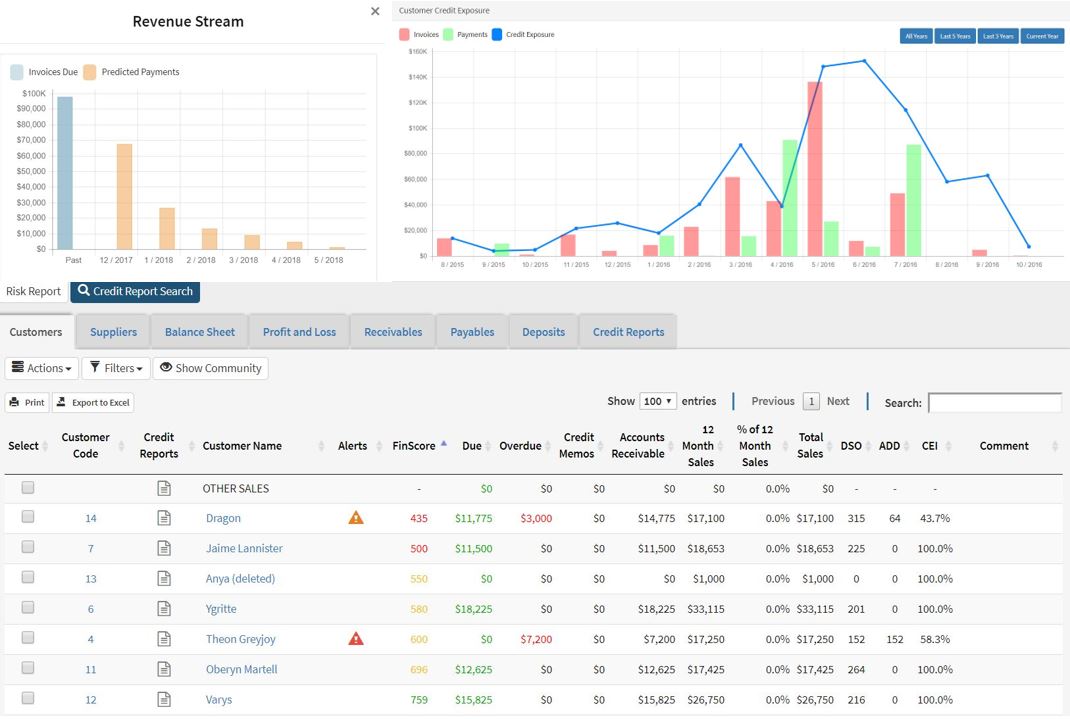

CRiskCo Provides an alternative credit report using CRiskCo Monitor to show an individual credit score for each of your customers. This is different from what credit bureaus provide you as it is based on actual accounts receivable information from the customers cloud-based accounting systems. It can give you real-time credit data, reliable risk assessment and predict when the customer will likely pay next.

Once you have understood how risky your clients are, you may want to take steps to reduce the risk posed by them if there are any. Below this is a list of methods that a business can use to reduce the risk of defaulted clients and ensure cash flows into the business.

Invoice Discounting A business offering a customer discount for early payment or within a certain time period that is less than the due date of the invoice. (ie; Offering 5% discount if the invoice is financed within 3 days of purchase)

Benefits: Creates a stronger incentive for customers to pay early and thus improves your cash flow, Low costs vs other solutions and keep your clients happy (discounted rate).

Concerns: Your customers may get used to the constant availability of discounts and may start to demand more of it. If your clients have cash flow challenges as well they may not act upon the offer.

Invoice Financing/ Factoring This method involves selling your invoice to a factoring company to get rid of the risk completely. Imagine that you have a $100 invoice held by a company that is at risk of default for any reason. By selling the invoice to the factoring company you will receive immediate cash and pass on the risk to the factoring company. It is then up to the factoring company to collect the debt from the risky customer. The pinching point is that you only receive about 85-90% of the value of the invoice. So you get immediate cash but not a 100% to the value of the invoice.

Benefits: Invoice factoring is getting faster with the online factoring solutions, and it is a straightforward process which quickly mitigates the risk posed by the defaulting company and gives you immediate cash.

Concerns: This is by far the most expensive solutions as you need to pay 10% -15% of the value of your invoice to the factoring company. Smaller valued customer invoices are not up for purchase, thus you are paying a lot for the invoices that are accepted and still having to handle the risk of the invoices that are not accepted.

Traditional Invoice Insurance This solution involves you applying to insure your entire portfolio at the cost of a commission of 0.5% – 2% of the total value of your portfolio. The insurance will cover lost invoices in case of finacial default and up to the stated cover (70% -85%).

Benefits: The risk of approved customers are directly reduced and it is a much cheaper solution than the “Invoice Financing/Factoring” solution mentioned before. It doesn’t solve cash flow but will make sure that your business doesn’t suffer a big hit due to a big default.

Concerns: Firstly, your entire portfolio must be approved by the credit insurance company and then each and every one of your customers must be approved and set a line of credit. Small to Medium businesses suffer significant difficulties as the majority of their smaller customers will not be approved for credit insurance due to size. “Insurance is like Swiss Cheese, it contains a lot of holes that are only found when you need to cash out” – NYC Shoes Distributor.

Single Invoice Credit Insurance The newest real-time insurance solution that is set to rock the boat in the credit risk world. Single Invoice Credit Insurance is built on the basis of choice whereby you have the option to specify a vendor or invoice that you would like to insure in real-time. Forget about time-consuming, costly and stressful processes that is needed in the “Traditional Invoice Insurance” to approve your entire portfolio. This innovation gives businesses of all sizes the power to choose on the spot which customer’s invoice they want to insure and when they want to do it. It provides an easy one-time premium rate for each insured invoice without any hidden fees or brokerage fees. CRiskCo is the pioneer in this credit insurance solution with new ways to get more effective cover for your invoices.

Benefits: If you want to get insurance for several of your customers and not the entire portfolio, this is the most effective and cost-effective option. This solution gives you operational flexibility to control your company risks.

Concerns: Not all customers will be eligible for cover. Costs are higher if you wish to use it for all your customers and compare it to the traditional cover for your portfolio.

Reverse Factoring A finance company pays the invoice to the vendor and at a discount in exchange early payment. This is called a letter of credit as the business will pay the finance company the full amount at a later date.

Benefits: It allows you to scale your business and acquire more goods quickly to sell. Maintain your cash flow, especially with long credit sales.

Concerns: This solution could potentially increase your businesses risk as you take on more debt. The costs may vary largely from a standard low-cost business loans for heavy equipment to high cost similar to the “Invoice Financing/Factoring” solution (up to 15% on the total value of invoices).

All in all when it comes to running a business, trade credit is part and parcel to maintaining cash flows and relationships with customers – Selecting the right solution for you and your business is key and it can be made easier knowing the cheapest and fastest product in the market.

Summary

| Tool | Description | Benefits | Concerns | Example providers |

| Invoice Discounting |

|

|

| All companies can do this on their own |

| Invoice Financing/ Factoring |

|

|

| Hedaya Capital, DS-Concept, Bluevine, |

| Trade credit Insurance |

|

| • A long and manual process • Small to Medium applicants almost never get approved. | Euler Hermes, NCI, Coface |

| Single Invoice Cover |

|

| • Not all customers will be eligible for cover. • Costs are higher if you wish to use it for all your customers. | CRiskCo |

| Reverse Factoring |

|

| • Provide solution for a specifique scenario • The costs may vary largely. • Might increase your businesses risk as you take on more debt. | Behalf |

Related Posts

Case Study: Imagina Leasing’s Improved Credit Decisions

Executive Summary Imagina Leasing, a leader in Mexico’s leasing industry, was on a mission to enhance the precision and security of its credit evaluations. Facing challenges in verifying financial documents and managing risks, they turned…

- Nov 14

Strengthen Risk Management with the New Financial Suppliers Tab

We’re thrilled to unveil an exciting update to our UI! Introducing the “Financial Suppliers” tab, now available on the company reports page and in the SAT information report. Know Your Competition and Past Financing Deals…

- Jul 29

Recent Posts

Subscribe

Join our newsletter and stay up to date!